Finance

Understand The Benefits of The Net Working Capital to Your Business

Are you worried about the company’s financial health? Look at what the working capital is screaming. Even for the successful operations of your organization, you have to pay attention to the working capital. A good business will always be able to reap the maximum benefit out of its working capital.

Now the most relevant question is, what is net working capital? To put it plainly, it is related to the company’s current assets and current liabilities. It indicates the organization’s liquidity and financial stability. There’s a difference between the company’s current assets and current liabilities; net working capital stands for that difference.

Here we will talk about understanding the importance of the net working capital that can provide support to the organization:

- The first advantage is to have flexibility. Money is power. When you have the proper financial support, you can rule the world. With gross working capital in hand, which is also the current asset, you can satisfy the requirements of your customers in a better way… how? Well, when the production is unperturbed naturally customers’ needs will be fulfilled timely. Now, this steady flow of production will also ensure the solvency of the business. When you have adequate money at your disposal, you will be able to face crisis situations such as recession or depression in the market boldly.

- The reputation of your business plays a pivotal role in maintaining an amicable relationship with the vendors, suppliers, distributors, and more. With adequate net working capital, you can make payments on time, and your goodwill in the chain will be maintained. In business, a good name means everything.

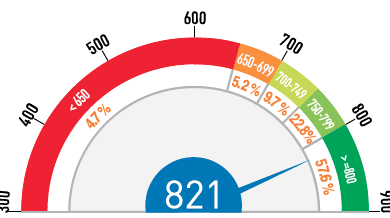

- When you have enough net working capital, investors will want to invest in your concern. Yes, the amount of net working capital provides confidence to investors and stakeholders of the company. In fact, banks will readily accept your loan application if you can show them that you have a good amount of net working capital. You can consider net working capital to be the lifeblood of your business. Yes, high solvency and impressive credit score will undoubtedly fetch you more investment and bank loans to grow your business.

- If you love to save money, adequate net working capital can aid that. While buying stuff for your organization, you can avail impressive discounts on inventories. Hence, this reduces the overhead cost of running an office space. Stationeries, furniture, photocopy machines, printers, coffee vending machine, paper cups, etc., cost a lot of money. Don’t believe us? Add up the total cost, and you’ll know what we’re talking about.

- As stated earlier, the gross working capital is critical when it comes to paying the salaries, wages, and incentives of the employees, workers, and more. Employees are assets to the company. Hence, it is of critical importance to keep them happy. If you fail to pay their salaries on time, they will either quit your organization or stop working wholeheartedly. Plus, for a good resource in your company, not receiving the salary on time is kind of demoralizing. The spirits of the employees remain strong when they receive what they deserve. They derive determination and power from their confidence to work harder and prove their worth. Ultimately the company benefits as well as the employees. So, you see, it is a symbiotic relationship. One cannot thrive without another.

- With adequate net working capital, you will be able to purchase the raw material for your products in bulk when there is an increasing demand for the raw material in the market or when the price is on the lower side. This is a viable way to exploit the market situations for your monetary benefits. Without enough working capital in hand, you will not be able to do this and lag behind in this steep competitive market.