Finance

How to Close Credit Cards without Hurting your CIBIL Score?

In case of financial emergencies, a credit card is a great backup tool. Nonetheless, overspending can cause this funding source to become a liability. This makes it difficult for a customer to keep track of his/her payments, due dates and annual maintenance fee.

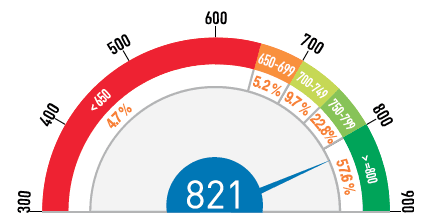

For these reasons, if you plan on closing your credit card, you need to understand that doing so will affect your CIBIL score.

A CIBIL score improvement agency in Mumbai recommends keeping the credit utilisation rate under 30% to keep the credit score undeterred. Other than this, several other factors come into play when you close your credit card.

Why do individuals choose to cancel a credit card?

Few situations that impact an individual’s decision to cancel a credit card have been mentioned below

- The benefits and high annual fees make it more of a financial burden rather than a facilitator.

- The interest rate of these cards is high, and you need to always ensure you don’t cross the set limit.

- Anyone with a long-term debt finds the card an appealing way to pay it off. However, the high-interest rate only increases the debt load.

- When an individual wish to avoid future financial liabilities by extensively using his/her credit card for high-end purchases.

How to cancel your credit card without hurting your credit score?

-

Time and impact of cancelling your credit card

Cancelling your credit card will immediately cause your credit score to drop. This is because when you cancel your card, the unutilised credit becomes less than the debt you have accumulated. While it helps avoid long-term financial drainage, however, recovering your credit score after the drop takes time. So, reconsider your decision to cancel your credit card first.

-

Paying off the balance

Understand that the amount of limit on your credit card that is utilised needs to be paid off first. Your credit card account won’t be fully closed unless this balance amount is cleared. Individuals with multiple credit cards can lean towards a snowball method of payment. This involves clearing off the smaller debts before tackling large ones.

-

Contact financial institution or NBFC to cancel

Call and communicate to the financial institution or NBFC that you wish to close your credit card account. Confirm with them that your current balance is zero. Often there might be some residual interest accumulated on the last payment. CIBIL score improvement agencies in Mumbai or elsewhere suggest paying off this interest before closing your account.

-

Generate a letter or email for record

You must maintain a record of closing your credit card with you. That is because credit card cancelling causes credit scores to drop. Therefore, keeping written documentation for the same eliminates room for error and helps avoid negative repercussions.

-

Check CIBIL to ensure the account is closed

You will receive a copy of your credit report ensuring your account is closed. It takes around seven years for delinquencies and late payment impacts to disappear. However, in case of good credit history, you can retain a favourable score.

So, avoid cancelling credit cards if you still have outstanding payments. As the impact on your CIBIL score takes time to recover. It is also recommended to keep the credit accounts open to ensure that your CIBIL score remains high.

Further, check CIBIL score for free periodically to ensure that it does not drop even if you close your card. It will help you monitor and ascertain your financial credibility.