Finance

Why Fixed Deposit Should Be in Your Investment Portfolio

The majority of the new generation’s investors want to invest in market-linked products like mutual funds. Even if it is a wise decision, Fixed Deposits cannot and should not be excluded from your investing portfolio. With financial institutions offering one of the best FD interest rates ever, one should look into FD as a viable investment option.

FDs are an excellent complement to your investment portfolio, and we’ll explain why:

Invest in Fixed Deposits for the Following Reasons:

- Fixed Deposits (FDs) Assist in lowering your portfolio’s risk:

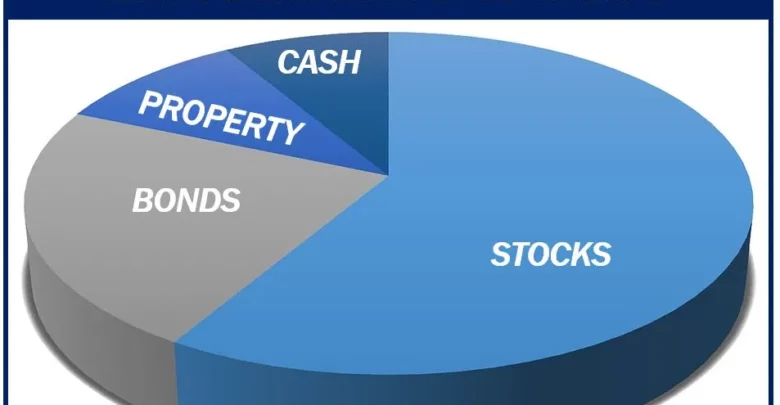

Asset allocation is one of the most effective strategies to build wealth. There are many distinct asset classes, such as stock, gold, fixed deposits, and so on, and each one plays a different role in your investing portfolio.

On the one hand, mutual funds give long-term growth potential for your money; on the other hand, fixed income solutions such as Fixed Deposits provide portfolio stability by providing guaranteed returns.

Suppose you diversify your portfolio across several asset classes, which includes FDs. In that case, you can keep the swings in your investment returns to a minimum and enjoy a stress-free investment experience.

- FDs are the Best Investment Option for Time-Constrained Goals:

Fixed Deposits provide assured returns at the end of the term. As a result, if you have some immediate financial goals for which you need a specific amount within a particular time frame, you should include fixed deposits in your investing portfolio.

Consider the case where you require Rs. 2 lakh for your child’s school admission after two years. You know exactly how much money you’ll need after a set period in this situation. In this instance, the ideal investment option is a fixed deposit.

As a result, you can deposit your money by looking at the best FD interest rates and the tenor. In this manner, you’ll be able to achieve your goal within the timeframe you desire.

- Fixed Deposits Offer Guaranteed Returns on Maturity

When you invest your money in a fixed deposit, you know exactly how much you’ll get when it matures. Regardless of the economy’s performance or the rate of interest’s decline, you will receive the interest rate agreed upon at the time of the FD deposit.

This aspect of a fixed deposit allows you to budget because you know how much money you will get after a set period.

- You Have the Option of Using Cumulative or Non-Cumulative Terms:

You can pick between non-cumulative and cumulative interest rates on fixed deposits. It means you may choose when you wish to get your interest earnings. If you rely on interest income to pay your expenses and EMIs, you can choose between quarterly and monthly pay-outs and non-cumulative FDs.

Alternatively, you might keep your fixed deposit savings locked up until the term of the FD expires. So, if you choose the cumulative time, you’ll get compounded interest when your FD matures.

- Funds Withdrawal Flexibility:

You can quickly withdraw your fixed deposits before the term expires if you have a financial emergency. You may have to pay the penalty in this instance, but withdrawing before maturity or prematurely is straightforward.

This adaptability allows you to get your money when needed or if a financial catastrophe strikes. An FD is a safe investment that provides excellent returns due to its flexibility.

- Easy Credit Access:

You can borrow money against your fixed deposit whenever you need it. In most cases, banks will lend up to 70% of the amount of the FD as a loan. The interest rate for borrowing against an FD is likewise competitive.

- A Good Way to Meet Your Short-Term Goals:

Short-term goals are financial objectives that you wish to reach within one to three years of investing. The primary goal of these objectives is to protect the investment while also earning a small bit of income. As a result, FDs are one the most profitable solution for achieving such investing objectives. Financial institutions also provide the best FD interest rates for the short term.

Conclusion

It should be evident that FDs can be an excellent addition to your investment portfolio. However, keep in mind that FDs are appropriate for short-term objectives.