Business

Get to Know About the Bajaj Finserv Insta EMI Card Login Portal

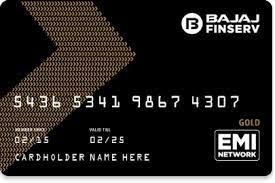

Bajaj Finserv Insta EMI Card Login

The Bajaj Finserv Insta EMI Card login portal is easy to access, has a clean design and is user friendly. It also responds with readiness to any input. To experience it first hand, you should visit this portal.

As you log in, you come face to face with a simple layout and simpler explanations. Simplicity is the speciality of the best websites in the world. They take all the fringe elements out and allow you to focus on the essential factors that should have your attention. The website for the Bajaj Finserv Insta digital EMI Card is one such.

On the left of the landing page, it shows you the three easy steps through which you get your card. They are:

- Get instant approval

2. Verify your details

3. Activate the Insta EMI card

In practice, it is actually that simple and that quick. The portal asks you to enter your mobile number and your date of birth. There should be no ambiguity in this. Remember to enter the number associated with (linked to) your Aadhaar card and other official associations, such as the PAN. Also, your date of birth should be the same as the one mentioned in your PAN. These details are important, so take some time over this, if needed. An error in these will not allow you to access this card.

You can go ahead with the basic approval process, but maybe you should stay on the landing page for a while and read other entries on it, such as the features and benefits of the card.

These are clearly laid out, some just one scroll-down:

- a)The card has a 100% digital process, so you can do all this sitting in your home or in the office or wherever you have internet connectivity.

- b)The basic approval, as you enter your initial data, takes just 30 seconds. That is one reason why the word ‘Insta’ has been added to the card’s name.

- c)You can get up to Rs. 2 lakh financing when you get registered with this card.

- d)No physical documents are required to be submitted during the Bajaj Finserv Insta EMI Card login

- e)Having registered with the card, you get access to over 1 million products, all on easy EMIs.

- f)All this is available across 2,300-plus (this number keeps growing) cities across the country.

- g)The card is accepted in over 1 lakh partner stores (this number, too, keeps growing), and

- h)Your payment tenor can be up to 24 months!

You can get more information on the portal from the Frequently Asked Questions (FAQ) section as you scroll down. Here are some basic information on the eligibility criteria.

Basic eligibility

You must be between 23 and 65 years old. You should have the supporting KYC documents, and you should have paid the joining fee of Rs 530.

Keep the following documents nearby so that you can enter the required details that will be asked of you during the process. These are your PAN Card, Aadhaar Number for KYC confirmation and your Bank account number and IFSC for e-mandate registration.

To register your e-mandate, the portal will ask you to share your bank account and IFS Code, then verify all the details entered and finally submit the OTP you receive on your registered phone number for validation purposes. There is no elaborate paperwork involved.

The functionality

The website’s functionality is crisp, and navigating to and beyond the landing page is easy. The response time is also quick. When you initially enter the mobile number and date of birth, the portal returns with a response within 30 seconds.

Quick activation

Quite like the quick response of the portal, you will be able to activate your digital Bajaj Finserv Insta digital EMI Card almost instantly. As you activate the card, you can download the card into your Bajaj Finserv app. You can immediately start shopping with the card with no waiting period.

The marketplace

The card will bring you face to face with an array of goods (many more available through partner tie-ups, such as MobiKwik). You can avail of all these through the card’s charge-free EMI facility. The card does not charge any interest on your purchase, even if you choose the two-year-long payment option. Therefore, you only pay the price of the goods you buy and no more.

This level of access is available in many cards, though the special, long, interest-free EMI periods associated with this card make it stand out in the crowd. Thus, while the spread may seem like what you have already seen, in this case, your purchasing power has been enhanced.

With such a treat waiting for you, it is worth it to prepare ahead of logging in.